Пассивное или активное инвестирование: какую стратегию выбрать инвестору

Какую стратегию инвестирования выбрать инвестору

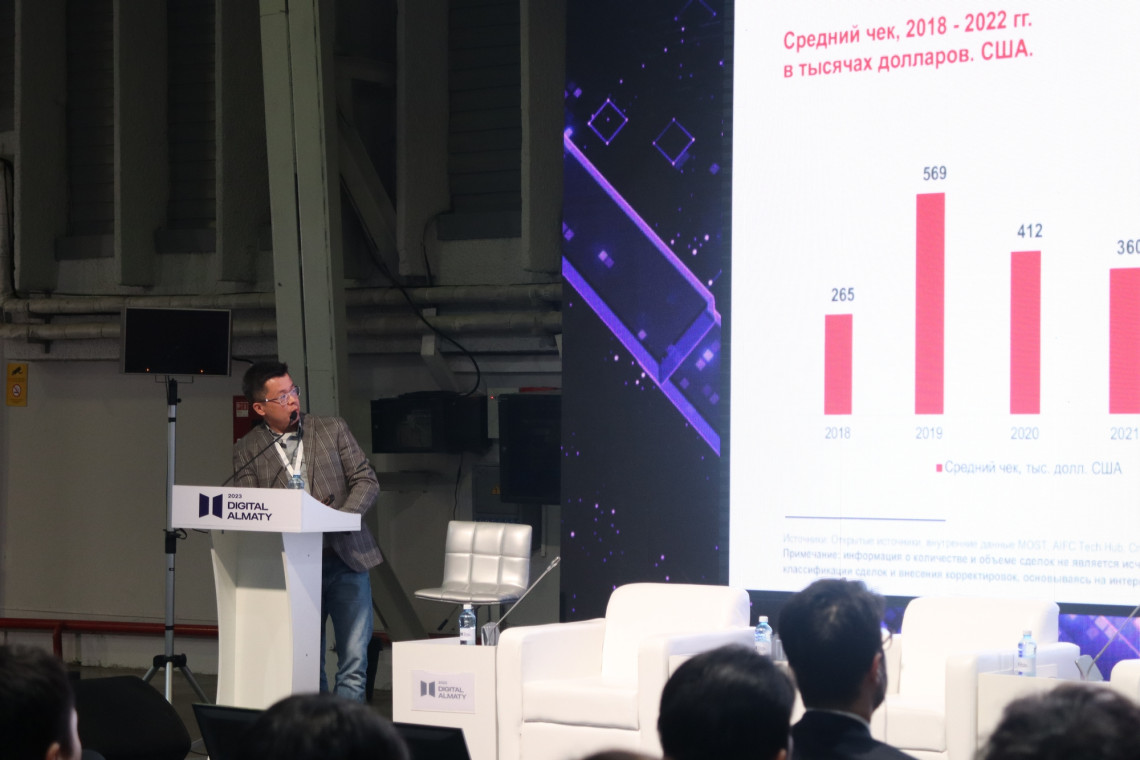

At the Digital Almaty forum, the Managing Partner of MOST Ventures, Alim Khamitov, presented the first venture capital market research in Kazakhstan. It was prepared on the initiative of MOST Holding in partnership with White Hill Capital and Tech Hub of the Astana International Financial Center (AIFC).

The team of analysts collected all publicly available data on the venture capital market in Kazakhstan for the period from 2018 to 2022. According to the report, the total volume of public transactions in the country's venture capital market during this period amounted to $87 million with 175 transactions, with 84% of them related to the pre-seed and seed stages of startups. However, it’s noted in the document that the $87 million figure only represents ~60% of total market activity, as a significant number of transactions are not reported or disclosed by participants. Therefore, analysts estimated the total volume of transactions for four years at $145 million.

Most of the transactions took place in the early stages, which indicates the faith and support of investors for startups without a stable financial model at the beginning. The average size of venture capital transactions in Kazakhstan in 2021 amounted to $360 thousand, and in 2022 it increased significantly, reaching $800 thousand. This suggests that the market is ready for transactions worth several million dollars this year.

MOST Ventures Managing Partner Pavel Koktyshev expressed hope that the research will provide local and foreign investors and market participants with the necessary information to understand the industry, as well as help to improve the market ecosystem for its further development.

“In this research, we tried to highlight not only the dynamics and current state of the venture investment industry in Kazakhstan, but also analyze trends, development prospects and key market problems. We hope that this report will fill the lack of information about the venture capital market in Kazakhstan and will contribute to the emergence of more success stories in the market,” said Pavel Koktyshev.

Due to the growing penetration of the Internet and the relatively young population in the country, the most common startup areas for investment are marketplaces/e-commerce and fintech.

Marketplaces/e-commerce and fintech are the most common startup areas for investment, due to the growing penetration of the Internet and the relatively young population in the country.

It is also noted that business angels and venture capital funds are a key source of capital. 45% of the amount of venture transactions were financed by business angels. At the same time, about 200 investors prefer not to advertise their activities and ongoing transactions.

The research did not bypass the problematic issues that hinder the development of the venture capital market. At the moment, there are trends in Kazakhstan that indicate that the Kazakh venture market is still not mature enough due to low checks compared to other countries, a small consumer market, the absence of institutional players, and the unpreparedness of corporations to implement innovations. These reasons lead to a brain drain of IT professionals who are looking for larger markets and funding opportunities abroad.

The researchers add that despite all these pitfalls, the growth in the number of venture capital funds and investment clubs in Kazakhstan, both domestic and international, indicates a growing interest and potential for investment in the startup ecosystem.

“The venture capital market both in Kazakhstan and around the world is quite closed in terms of access to information. At the same time, in more developed markets, there are separate structures, usually functioning in the form of associations, that monitor, consolidate market information and determine the methodology. Such work has not been carried out in Kazakhstan before, therefore, in conditions of limited access to information, we are pleased to present such a large amount of useful information for all market participants,” added Aslan Sultanov, Managing Partner of White Hill Capital.

The authors of the research suggest ways for the development of venture capital. According to the report, the country needs a comprehensive approach and simultaneous work on all components of the ecosystem, including the legislative framework, increasing tax incentives, reducing restrictions on the investment strategies of banks, pension funds and insurance companies, increasing the number of co-investment and guarantee schemes, creating a reliable environment for “ exit”, as well as building up the professional competencies of market participants. With the implementation of the above measures, Kazakhstan will be able not only to ensure a stable inflow of investments, but also create prerequisites for sustainable economic development in the coming years.

“The report contains information about what steps the government has taken to stimulate the venture capital market. Among them is the launch of the Astana International Financial Center, which certainly increased the investment attractiveness of the country with the help of its jurisdiction. This is legislation that allows you to choose and register from a variety of forms of foundations. This includes the possibility of creating trusts and private foundations. We hope that this research will be distributed among foreign investors, for whom the right legislative framework is undoubtedly important,” summed up Arslan Kudiyar, Deputy General Director of the AIFC Tech Hub.

You can download the full version of the research on the website:https://mostfund.vc/research

*The use of information from the report is allowed only with a direct indication of the research and site of the research

Укажите адрес Вашей электронной почты и мы будет отправлять уведомления о грядущих мероприятиях. Не волнуйтесь, спама не будет

Если вы хотите стать инвестором, пожалуйста, заполните следующую форму, и мы свяжемся с вами в ближайшее время